Bank transfer

Bank transfers (also known as SEPA Credit Transfer) are a secure, trusted, international banking method. Customers can make any type of online payment in euros within the SEPA area.

Read how bank transfers can benefit your business on multisafepay.com

| Supports | Details |

|---|---|

| Countries | Europe (SEPA area) |

| Currencies | AUD, CAD, CHF, CZK, DKK, EUR, GBP, HKD, HUF, JPY, NOK, PLN, SEK, USD |

| Payment components | Yes |

| Payment pages | Yes (current and deprecated versions) |

| Refunds | Yes: Full and partial |

| Virtual IBANs | Yes, to better manage bank transfer payments |

Payment flow

This diagram shows the flow for a successful transaction. Click to magnify.

Payment statuses

The table below sets out the order status and transaction status for payments and refunds.

| Description | Order status | Transaction status |

|---|---|---|

| Awaiting the customer to transfer the funds. | Initialized | Initialized |

| MultiSafepay has collected payment. | Completed | Completed |

| You cancelled the transaction. | Void | Void/Cancelled |

| The customer didn't complete payment within 60 days. | Expired | Expired |

| Refunds: Refund initiated. | Reserved | Reserved |

| Refunds: Refund complete. | Completed | Completed |

Activation

- Sign in to your MultiSafepay dashboard .

- To activate the payment method for:

- All websites, go to Settings > Payment methods.

- A specific website, go to Websites, and then click the relevant website.

- Select the checkbox for the payment method, and then click Save changes.

💬 Support: If the payment method isn't visible in your dashboard, email [email protected]

Integration

API

-

See API reference – Create order > Banking order.

Example requests

For example requests, on the Create order page, in the black sandbox, see Examples > Bank transfer direct/redirect.

Settypetodirectorredirect.

-

Transactions expire after 60 days.

Ready-made integrations

Supported in all ready-made integrations.

Testing

To test bank transfers, see Testing payment methods - Banking methods.\

User guide

Local MultiSafepay bank accounts

To simplify transfers for customers and avoid them incurring international transfer and currency conversion fees, MultiSafepay has a local bank account in several European countries in the local currency. Customers then only pay the standard fee charged by their bank.

To send a customer the details of a local MultiSafepay bank account, include the relevant ISO 3166 country code in your create order request in the country parameter, e.g. "country": "DE".

Countries with a local MultiSafepay bank account

| Country | Currency |

|---|---|

| Austria | EUR |

| Belgium | EUR |

| Czech Republic | CZK |

| France | EUR |

| Germany | EUR |

| Hungary | HUF |

| Italy | EUR |

| Netherlands | EUR |

| Poland | PLN |

| Portugal | EUR |

| Spain | EUR |

| UK | GBP |

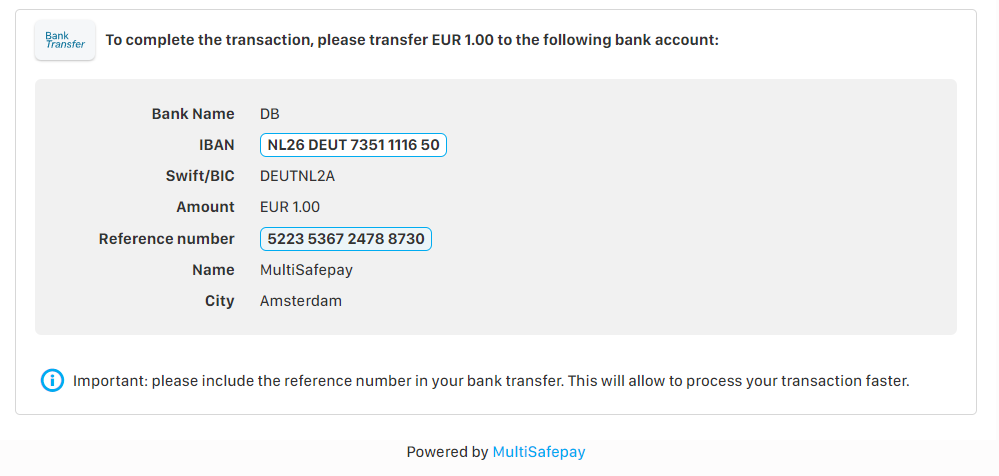

Payment instructions

MultiSafepay emails the customer the following payment details to include when transferring the funds, or your can email them yourself.

⚠️ Note: Bank accounts are always displayed in IBAN format. See also Unmasking IBANs.

How to email payment instructions yourself

You may prefer to email the customer the payment details yourself, e.g. for consistent, branded communications. Make sure you include clear instructions about what details the customer needs to provide, and the required format (see Transfer guidance for customers below).

To prevent us from emailing the customer:

- See API reference – Create order, under Body params > select Banking order

- Click customer object, and set the

disable_send_emailparameter totrue

Transfer guidance for customers

The customer must only pay for one order per bank transfer. When transferring the funds, provide:

- The amount

- Their bank account number

- The payment reference number (not the order number)

Format: 16 digits, numbers only, no words

NoteCustomers must enter the details accurately to avoid unmatched payments (see below).

Matching payments

When we receive payments, we automatically match them to the corresponding transaction in our system by the amount and payment reference/customer bank account number.

Automatic matching can fail if the:

Payment details are incorrect, missing, or incorrectly formatted

We may not be able to match a payment if the customer:

- Transfers the wrong amount

- Pays for multiple orders in one transfer

- Enters the payment reference number incorrectly, or includes words, e.g. "Payment ID 5213 0452 1234 5670"

- Provides the order number instead of the payment reference number

Sometimes, the customer's bank has added comments to the transfer.

Transaction wasn't successfully created

The customer made a transfer but did not:

- Place their order with you, or

- Click Confirm on the payment page (redirect orders).

This means the transaction was not created successfully in our system.

We then try to match the payment manually. If that fails:

- For smaller amounts, we refund the customer.

- For larger amounts, we contact you for information to help identify the correct transaction.

Resolving unmatched payments

To resolve unmatched payments, check if a transaction was created:

Transaction created

- Click the link to open the payment page.

- Click Bank transfer.

- If the customer didn't fill in the Bank account number field, enter their bank account number (if known) to help us match the payment.

- Click Confirm to create the transaction in our system.

Transaction not created

- Generate a link manually.

- Include in the description the customer's name and the order number (for your records).

- Click Bank transfer.

- Add the customer's bank account number (if known) to help us match the payment.

- Click Confirm to create the transaction in our system.

💡 Tip! The order ID must be unique for each payment link.

See this guidance in Dutch or German.

Stock issues

To avoid stock-related issues if a customer fails to pay within 60 days, you can hold your inventory in your backend until they complete payment. This depends on your ecommerce platform or integration, and your products and/or services.

❗ MultiSafepay bears no responsibility for stock-related issues.

Validation

To change how bank transfers are validated, check whether this is possible in your backend.\

Support

Email [email protected]

Updated 24 days ago